Have you ever wondered if there were prerequisites to raising venture capital? Raising venture capital for startups is both a process and campaign. It requires strategy, preparation, confidence, and salesmanship. In this article, we are going to cover what investors expect before fundraising so you can avoid the mistakes that waste time, burn credibility, and lead to preventable rejection.

Since late 2022 and into 2023, fundraising dynamics shifted toward higher standards of proof, stronger diligence, and more emphasis on capital efficiency. Investors still fund compelling companies, but many founders underestimate how much readiness matters before they start booking meetings.

Across founders working through structured fundraising preparation frameworks inside our Accelerator, one issue shows up repeatedly. Many confuse activity with progress. Traction needs to be framed around signals that reduce investor uncertainty, not vanity metrics.

Key principle: Fundraising amplifies what already exists. It does not fix broken fundamentals. The goal is not to raise money as fast as possible. The goal is to raise money for the right reason at the right time with a clear plan for what the capital unlocks.

By the end of this post, you will understand what is needed to confidently know when you are actually ready to begin raising investment, what traction means to investors, what traction should mean to you, and what you should prepare before you run a fundraising campaign.

This article focuses on readiness and preparation before fundraising begins. Once a startup reaches that point of preparedness, the mechanics of actually running a venture fundraising process are covered separately, which you can find in our article, How to Raise Venture Capital for a Startup.

Why Most Startups Approach Fundraising Too Early

Startups often approach raising venture capital prematurely by trying to pitch an idea without having anything concrete to prove demand, execution ability, or momentum. Many founders believe they have the next billion dollar concept, but from an investor perspective an idea without proof is almost pure uncertainty.

When a VC is slightly interested, one of the most common responses founders receive is some version of: we need to see more traction. That is not a rejection of you as a person. It is a signal that the risk profile is too high for the stage, check size, or investment thesis.

Pre seed firms, angels, and some accelerators may invest before a fully built product, but even then they typically want something beyond the idea itself, such as unusual founder market fit, early validation data, a waitlist with strong conversion signals, clear distribution advantage, or evidence you can execute.

If you are exploring non VC approaches, here are additional options to consider: ways to fund your startup.

How Venture Capital Actually Works From the Investor Perspective

The easiest way to understand what you need before raising is to understand how venture capital works. Venture capitalists manage funds that are raised from limited partners and then deployed into startups. Their success is tied to the outcomes of those investments, and venture returns tend to be driven by a small number of outsized winners.

Because of that, venture firms optimize for companies that can become very large. They generally look for markets with enough upside to support massive outcomes and business models that can scale meaningfully over time.

Investors are not simply asking whether your idea is interesting. They are asking whether the opportunity can be huge, whether the team can execute under uncertainty, whether traction reduces risk, and whether there is a believable path to scale.

What VCs Need to Believe Before Investing

- The market is big enough: there is a large and expanding opportunity with room for a category leader.

- Your wedge is real: you have a clear entry point that earns adoption and can expand.

- You can execute fast: your team can build, sell, learn, and recruit at speed.

- Traction reduces uncertainty: usage, revenue, retention, growth, or distribution proof shows pull.

- Capital has a purpose: the money buys specific milestones, not vague experimentation.

What Venture Capital Accelerates And What It Cannot Fix

Think of your startup like a performance vehicle. Your product or service is the engine. Marketing and sales are the fuel that keeps the engine running. Venture capital is the turbocharger and high octane fuel that helps you scale faster when the underlying system is already working.

If there is no engine, more fuel does nothing. If your product does not create value, if customers do not retain, or if your go to market motion is still guesswork, venture capital will not magically solve that. It will often make the problems louder and more expensive.

Simple rule: Venture capital should scale what works. It should not be used to search for what works.

What VC Should Buy For You

- Scaling a proven motion: hiring growth, sales, or partnerships to expand a repeatable channel.

- Key hires that unlock velocity: engineering, product, sales leadership, or operations to increase output and quality.

- Distribution leverage: partnerships, platforms, integrations, or channels that expand reach.

- Product expansion tied to pull: building what customers are already demanding, not speculative features.

- Speed during a timing window: moving quickly when the market rewards first movers or category leaders.

Why VCs Are Selective Risk, Failure, and Diligence

Venture capital is high risk because startups are volatile. Markets change, competitors emerge, team dynamics shift, and timelines slip. Once a VC makes an investment, they cannot easily reverse it the way someone can sell a public stock. That is why diligence exists and why many founders are asked to show more proof before a firm invests.

A common misconception is that VCs only care about the idea. In reality, they care about risk and the probability of an outsized outcome. Traction, team quality, and clarity of execution reduce perceived risk.

Common Reasons Venture Backed Startups Still Fail

- Scaling too early: hiring and spending before product market fit is real.

- Weak retention: growth without retention creates a leaky bucket that becomes expensive.

- Unit economics collapse: acquisition costs rise faster than value captured.

- Unclear positioning: the market does not understand why you exist or why you win.

- Execution drag: teams get bigger but output does not accelerate.

The VC Readiness Framework What You Need Before Fundraising

Most founders hear the word traction and assume it is the only requirement. Traction matters a lot, but investors evaluate a full risk profile. A strong fundraising position usually comes from strength across multiple dimensions.

The Six Dimensions Investors Evaluate

- Market: big enough upside, clear buyer pain, and room to expand.

- Product: a real solution with a clear use case and proof it delivers value.

- Traction: measurable pull from users or customers, not just interest.

- Growth motion: at least one repeatable acquisition or distribution path.

- Team: execution capability plus the ability to recruit and lead.

- Capital plan: a credible 12 to 18 month milestone plan tied to spend.

VC Readiness Checklist

- Can you explain the wedge: why customers start with you and why you can expand.

- Can you show proof: usage, revenue, retention, conversion, or signed commitments that reduce uncertainty.

- Can you explain growth: what is driving traction and why it will continue.

- Can you articulate risk: what could break and how you will respond.

- Can you justify the round: what milestones the capital buys and how success will be measured.

If you are still validating merit and market pull, review how to start a startup and how to validate a startup idea, or join our Incubator Program so you can build the foundation correctly.

When you are aiming for venture scale, you will also want to move toward product market fit. If you want a complete breakdown, read this: guide to product market fit with everything you need to know.

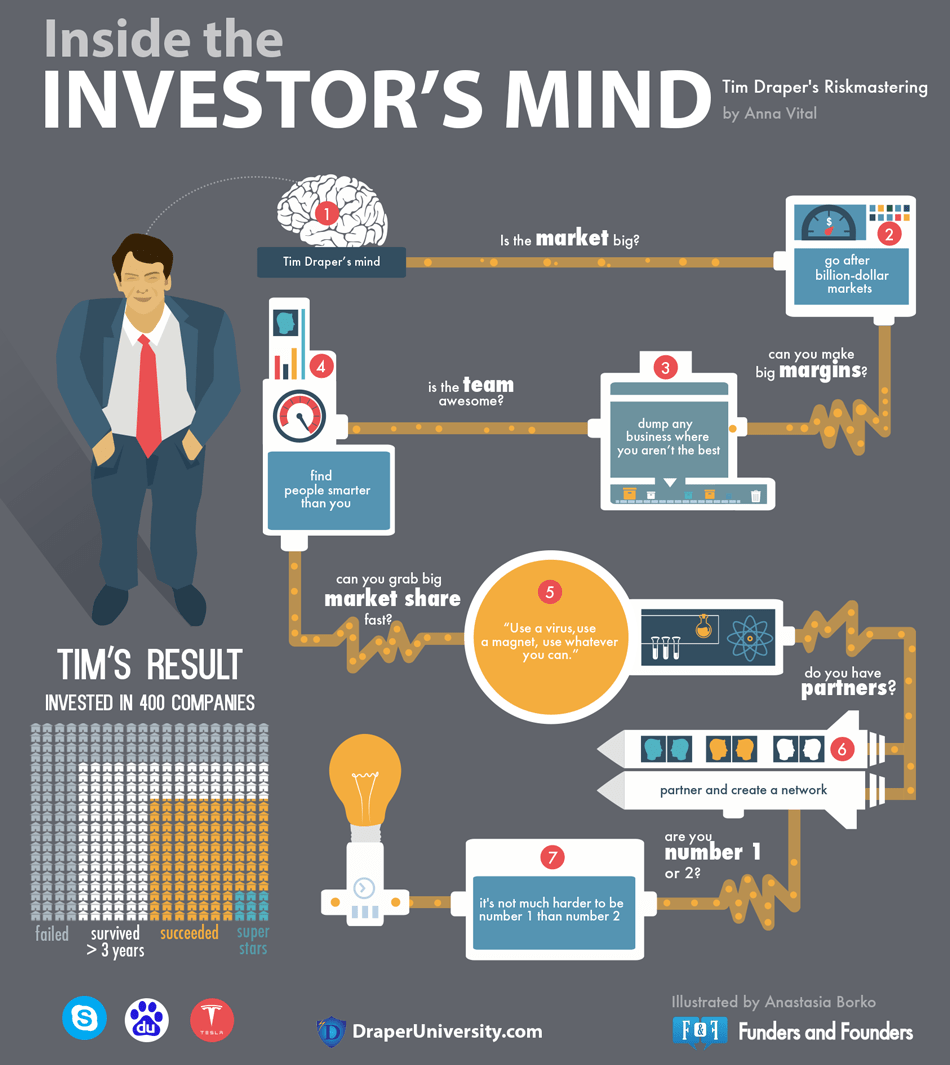

A Visual of How Many Investors Think

The infographic below highlights common investor lenses such as market size, margins, team strength, momentum, network effects, partnerships, and advantage. Use it as a reminder that traction is part of the story, but not the whole story.

What Traction Means to Investors And How It Is Measured

Traction is measurable evidence that people want what you are building. It can be paid or unpaid, but paid is usually stronger because it proves willingness to exchange value. Traction is meaningful validation because it reduces uncertainty about demand and about your ability to reach customers.

Traction is often expressed as growth over time, but quality signals matter as much as speed. Investors increasingly care about retention, engagement, expansion, and unit economics because those signals reveal whether growth is durable.

Traction Looks Different by Business Model

- SaaS: retention, expansion, activation rate, pipeline quality, sales cycle learning, and efficient growth.

- Consumer: activation, engagement, cohort retention, and organic sharing or referral behavior.

- Marketplace: liquidity, repeat transactions, supply and demand balance, and trust mechanisms.

- Physical product: margins, repeat purchase rate, supply reliability, returns, and demand consistency.

Growth Rates and KPIs That Help Tell the Story

There is no universal bar for traction because startups vary widely by market and model. That said, percentage growth week over week and month over month can be useful indicators, especially early. The key is to pair growth with quality signals, because growth without retention is fragile.

If you want deeper metric guidance, this resource can help: types of startup KPIs and metrics to measure with examples.

Investor translation: Do not just show numbers. Show why the numbers are happening, what you learned, and why the next 12 months will be stronger than the last 3 months.

Why Team Quality Still Matters to Investors

Traction matters, but so does the team. Investors underwrite execution under uncertainty. A strong team signals speed, learning ability, leadership, and the ability to recruit the right people as the company grows.

If you have traction and you are a solo founder, you may still be able to raise. If you have little traction but you are a proven operator with deep domain credibility, investors may still engage at the pre seed stage depending on the thesis. In most cases, the stronger your traction is, the more flexible investors become about other risk factors.

What VCs Mean When They Say Great Team

- Execution speed: you build and ship quickly without sacrificing quality.

- Clarity of thinking: you explain problems and decisions simply and directly.

- Customer closeness: you learn from users and adapt with discipline.

- Recruiting ability: you can attract strong talent as momentum grows.

- Leadership: you can align people around priorities and keep focus.

As your team forms, culture matters too. If you want to build a strong foundation, this guide can help: how to create a startup culture of excellence.

How to Build Traction Before You Raise Capital

Building traction is not one tactic. It is a progression. You validate the problem, build a minimum viable product, learn what creates value, improve retention, and then scale what works. The best fundraising story usually follows a clear trajectory of learning and momentum.

Idea Validation Prevents Disaster and Increases Investor Confidence

Many startups fail because they build something the market does not want. Rigorous idea validation helps you avoid that trap and gives you data that investors respect. When you can show that you ran real customer discovery, tested willingness to pay, and learned from the market, you reduce risk.

You can learn how to validate your idea for free, or via our Incubator Program through a free trial and cost effective membership.

If you already built something without deep validation, focus on user conversations and structured feedback. Do not pivot impulsively. Gather patterns, confirm what users actually want, and then iterate with intention.

Building a Minimum Viable Product

After validation, an MVP helps you turn insight into proof. Your MVP should be built to test the core value hypothesis and reduce uncertainty fast. If you want a complete guide, start here: how to build a minimum viable product. You can also review Guy Kawasaki’s MVVVP framing here: 10 rules for building disruptive technology startup.

With an MVP in hand, you can begin building a real growth story by testing channels, improving activation, and increasing retention and conversion over time.

Product Market Fit

As you build traction, you are also working toward product market fit. PMF is not a finish line. It is a set of signals that customers are pulling the product, retention is strengthening, and growth becomes easier. If you want a full breakdown, read: The Guide to Product-Market Fit: Everything You Need to Know.

When you can show early PMF signals, fundraising becomes easier because investors see durability rather than temporary spikes.

The Intangibles of Startup Growth Focus, Experimentation, and Learning

Every startup faces unique challenges while building traction. It often takes experimentation to discover what works. A good pace of testing helps you learn faster, but only if you track results and focus on what moves the business forward.

Measure, learn, and refine. Concentrate on the activities that are most meaningful, and discard those that do not build traction. Over time, your company becomes a more effective growth machine, which is exactly what investors want to see.

What Else You Need Before Fundraising Time Focus and a Data Room

Fundraising often takes longer than founders expect and it can become a major time commitment. Treat it like a focused campaign, not a background task. In most startups, the CEO leads the round.

When you have traction and you are ready to raise, you will also want a data room. A data room is a cloud based folder system that stores key documents you share with investors. The higher the round, the more diligence typically occurs, which means more organization and documentation is required.

Organize Your Data Room by Category

- Overview

- Financials

- Cap table and financing

- Market data

- Incorporation docs

- Team and stakeholders info

- Customer references

- Sales and marketing

- Product

Basic Documents to Include

- A pitch deck

- An executive summary

- A business plan or planning docs that explain strategy, milestones, and assumptions

Tip: Make it easy for investors to navigate. Use clean file names, keep one folder for metrics snapshots, and keep a simple index document in the Overview folder that links to the most important materials.

Conclusion

The moral of the story is simple: most startups should build traction before raising venture capital, especially for seed stage investment. Trying to do it the other way around often wastes time and credibility.

At the same time, the methods you use to gain traction are up to you, and they should be matched to your business model and market.

If you want the next article in this fundraising series, read: How to Raise Venture Capital for Early-Stage Startups.

You may also find this useful: 13 ways to fund your tech startup.

What have been your experiences with investors? Share your thoughts and experiences in the comments below.

2 Responses

As a software solutions architect, a startup scholar and practitioner in an ermeging ecosystem, I am truly intrigued by the insight you provide. I am certainly reading a lot about how to commercialize technology start-ups and will use you authoritative insights on how to practically incorporate this in my current work with startups.

Thanks Kamulegeya! I’m happy that you found the article helpful for you!