This is a best-practices guide to learn how to write a great startup executive summary for your startup or business.

There are two main purposes for writing an executive summary. One purpose is to use it for fundraising as investors will want one. The other purpose is to create an executive summary as a guideline or an abbreviated business plan for your startup to help you build a solid foundation for your business. You’ll get more information on it in the next section.

You can know nothing about starting a startup and by the end of this post, you’ll have learned about the main topics you need to concentrate on in order to create a successful startup. However, I’d definitely suggest you also read through this guide on How to Start a Startup to help you validate and build your startup step by step.

What is the Purpose of an Executive Summary?

An executive summary is an abbreviated version of a business plan which precisely highlights the main sections of it. It’s meant to be a lean version of your business plan with no extra fat.

It has two main purposes.

1) The executive summary would be used for providing initial due diligence for investors.

2) The executive summary would be used for organizing the main components of a business plan for a business, or probably in your case, your startup. It’s like a mini business plan.

Why is an Executive Summary Important?

For Getting Investment/Raising Capital

If you’re looking for investment from venture capitalists and/or angel investors, you’re going to need an executive summary because they will want to see what makes your startup a great investment for them.

This is true if even you’ve had a warm introduction to the VC and especially true if you’re cold-emailing them.

However, well-written executive summaries are preferred by investors because they don’t want to read huge business plans anymore. Assuming you’ve never spoken to the VC whom you’re emailing, sending your executive summary becomes the first interaction the VC has with you. Reading business plans take up too much of their time, and time is money. So, writing a huge business plan might be a waste of your time too.

Even though the above infographic shows how a business with a business plan gets better results with funding, the same is true for startups with executive summaries when emailing investors rather than without an executive summary.

This is evident when you go to venture capital firm websites and they ask for your executive summary and pitch deck more often than not.

That’s how investors get to learn about your startup, your team, and all of the other big topics before they decide to meet with you. That being said, you want to make a good first impression. Don’t you think?

The Goal of an Executive Summary when Raising Capital

The goal of your executive summary is to either get a meeting with venture capitalists or angel investors or to provide it to investors for due diligence at the end of your pitch deck presentation. It is not used to secure a deal instantly.

Then in that meeting, you will usually do your pitch deck presentation, answer questions, and ask questions.

The goal of that presentation is to get another meeting to perform additional due diligence on your startup. And hopefully, after that, you’ll get a term-sheet which outlines the terms of the investment and how much they’re willing to invest. But you don’t have to accept their terms.

It can also be used to help you with filling out applications for startup accelerators since you’ll need much of the information that you would have in an executive summary.

When You’re Not Seeking Investment

Writing an executive summary is an amazing tool for entrepreneurs and startups to utilize even if they aren’t seeking investment.

It’s a great way to map out your business strategy and can help you ward off some of the top causes of startup failure.

And it’s a document startup founders and entrepreneurs like yourself can go back to time and time again to help you refocus and stick to the plan.

Plus, it’s amazingly helpful because it will help you with multiple aspects of your development and growth that require the information written in your executive summary, such as content for your website, pitch deck, pitch, customer pain points, marketing strategy, financial forecasting and planning, and more.

1) The Attention Grabber

This is where you get the attention of the investor.

❗ Warning: If they don’t like what you have to say here, then they may not read any further.

Explain why your idea is so big or revolutionary in a few brief and to-the-point sentences. Speak about what you’ve developed and why it’s unique to solving a large problem.

Make it compelling and nail it!

Also, if you have any well-known or highly successful teammates with awards or accolades, then now is the time to mention that.

An awesome team who can get the job done well is valued above all else by investors.

Your elevator pitch should be almost synonymous with this attention grabber, so I recommend you check out this article by Hyde Park Angels called Pitch Your Startup in 30 Seconds. It covers the necessities of your pitch.

Why Now?

Having a sense of urgency from a market that needs your solution can be a strong motivator for investors so they can get in on the action while the time is right.

If now is an especially important time-frame, then briefly but accurately explain why the market is ripe and ready for your solution.

2) The Problem

Define your target customer/markets’ pain point or problem (current or emerging). The #1 reason why startups fail is that they make a product/service that doesn’t address and fix a problem of their target audience, so don’t make this mistake.

Show the size of the problem and the size of the market so you can show a contrast between the two.

Is there a percentage of people in that market with the problem or do they all have this problem?

Explain concisely.

3) The Solution

You’re looking to show your product-market fit (PMF) in this section. How do you have product-market fit? Don’t know what that is? Then I suggest reading this guide on product-market fit with everything you need to know.

But if you’re just starting out, you’re not going to necessarily know if you have PMF unless you validate your startup idea. And even then, you’ll need to see how your market reacts to your solution in real life. So you’ll be making assumptions with your solution until then.

However, going through an intensive idea validation process like StartupDevKit has in its idea validation course within the incubator program, will be a strong indicator that you have a solution that will stick. And investors will be much more confident in you when you have undergone a rigorous idea validation process.

Your customer-facing value proposition will be different than your internally used value proposition. What you see below is not how you will present your idea to website visitors and prospects.

That being said, your solution can be described through a value proposition like what you see below.

Your Value Proposition

We solve _______A________ by providing _______B________, allowing/helping _______C________ to accomplish _______D________ and/or alleviate _______E_______ . We make money with a ____F_____ business model by charging _______G________ to get/enable access to ______H_________.

- A: Problem

- B: Product/service offering

- C: People using product/service (specific)

- D: Specific task your offering improves/completes

- E: Pain point(s)

- F: Type of business model

- G: Users, companies, advertisers, parties for usage rights, etc (can be multiple parties)

- H: Value provided for money (this may be a different value than what was provided for

option C or it can be omitted).

Note that this value proposition formula will have to be altered based on your business model, which will be delved into within the next section.

You can then expand upon your solution to your target customer/market’s problem.

With the data you collected during idea validation research and interviews, you can share your findings and include any other relevant information to support the notion of your solution.

What will your users be able to do once you fix their problem?

How will you get it done? Be brief and concise.

4) Business Model

Show your business model in this section and how it’s supposed to function, driving your monetary success. Regardless of whether you’re looking for investors or not, you should always know your business model and keep it within this document for reference.

Below I explain and share why business models are important to have, how to create a basic business model, and I address the key points so you can know how to make a sustainable business model for growth.

Business models are important to have because it gives business owners and startup founders like yourself a clear vision of your primary mission and how you’re going to make money through your mission.

Here are 10 of the most popular B2B and B2C startup business models to use.

17% of startups fail because they have no business model, so make sure you have a business model.

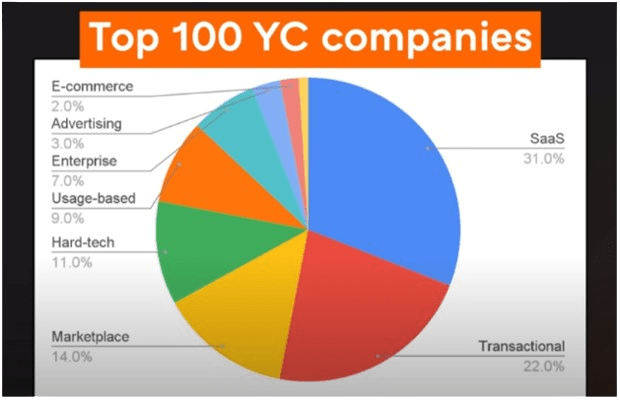

Top Eight Business Models from the Top 100 Y Combinator Companies

- SaaS – 31%

- Transactional websites – 22%

- Marketplaces – 14%

- Hard Tech – 11%

- Usage-Based – 9%

- Enterprise – 7%

- Advertising – 3%

- E-Commerce – 2%

Top Four Business Models of Unicorn Startups:

- SaaS

- Transactional Fees

- Marketplaces

- Social Networks

Your value proposition includes your business model, and using the value prop formula in the prior section will enable you to do that.

But below, you will see what you need to factor in to make a working business model with longevity.

A Sustainable Business Model for Long-Term Growth Must Factor in the Following:

- Provides excellent value to the target customer by addressing a key problem they face through a value proposition / unique selling proposition

- Shows how your business model is scalable

- Who your target customers are

- What your revenue streams are

- A fair and competitive price point for your product or service in the market

- There can net profits with a 40% or higher profit margin.

- Ample opportunities for lead generation through multiple different marketing/customer acquisition channels

- Consistent lead acquisition month over month and year over year

- Customer satisfaction and retention rates

- Key performance indicators

- The market size and longevity of the market

- Opportunity to capture significant market share

- Customer lifetime value (CLTV)

- How many people purchase services such as yours each month/year

- How your services/products will expand

You don’t have to list all of the above in your business model, but it’s important to take them into consideration before you decide what you’ll do.

And, your business model bust be strategically selected, but that doesn’t mean that it can’t change over time based on shifts in the market and/or shifts in your offerings.

Remember, getting your company off the ground and successful is the most important thing at the immediate moment. Crawl first, then walk, then run.

If you’ve got a business idea and want to figure out how to find your business model, the video below can help you with that.

From Business Idea to Business Model

However, creating a startup isn’t just about making money. Yes, it has to have a working business model, but it’s also about adding value to people and solving one or more problems within a niche or community.

According to an article from the Harvard Business Review by Kevin Laws, titled “Successful Startups Don’t Make Money Their Primary Mission”, it describes how founders and their startups are much more likely to succeed if they focus on a mission rather than focusing on dollar signs.

This is because they’re providing value to their target customers first, and asking for money second.

However, the goal of a startup is to make money and be profitable. That’s why it’s important that you have a business model that supports this.

5) Target Market & Size

Knowing your target market and size of the market is crucial for any business or startup to know. The more you know about your target customers, the more successful you’ll be at creating a successful product/service that matches your target customer’s needs.

In this section, you will present the facts of who exactly your target market is and how large it is. Break it down succinctly.

Target Market and Size Checklist

1) How many people are in the market (market size)?

2) What is the market cap? For example, XYZ is a $4 billion dollar market per year in the United States.

3) Are you selling to companies or to consumers (B2B or B2C)?

4) Share basic market demographics such as age groups, gender, location, the technology used (mobile/PC/tablet), etc.

Section Tips:

Make sure that this target market directly matches with your solution by following our short guide on How to Build Your Customer Profile.

If your purpose for this document is to show investors, then it’s important to realize three things:

- Investors want to see that there’s a large market for your product. A large market will have tens or hundreds of millions of people in it.

- Accredited investors don’t usually just invest their money in startups but also their time and other resources of theirs. This includes harnessing connections of theirs since they want to see their investment to succeed.

- If your target market is too small, then it’s going to be a waste of an investor’s time to invest in & work with you. It will also likely be a waste of your time trying to get accredited investment.

6) Traction, Expected Startup Costs, & Revenues

Many new entrepreneurs take the financial side of their startup for granted, especially if there’s no money flowing in yet in the beginning and can get caught up endlessly building the solution. However, it’s critical to focus on making money and adjusting your product/service based on how your market reacts.

Even if you’re not writing an executive summary for investors, then you should still, most certainly spend the time on this section.

Investors are usually looking for a 10x return on their investment or more. If you want them to invest in your startup, you must be confident that you’re going to make A TON of money and you’re going to provide the ROI they’re looking for. Your body language in a meeting can tell them a lot. Your vision for your company will matter just as much — as they seek founders who will run their company well and in alignment with their ethos.

Traction & Revenues

If you have traction, display it here. Do you have a huge waitlist if you’re pre-launch?

If you have customers: Show how many customers you have, what they have been buying, your retention rate and your churn rate.

Show what KPIs you’re tracking. Share your month over month (MoM) growth, quarterly growth, lead to customer conversion rate, and how much traffic you’re getting.

Show what your growth can look like with projections into the next 12 and 24 months, and even five years.

How much revenue will you bring in from each customer monthly, bi-annually, annually, in a lifetime (Customer Lifetime Value (CLTV))?

You can use a spreadsheet to represent the data.

Expenses

1) Are your costs low and profits high? If not, find ways to make it so. Find ways to automate things and make it more efficient if it’s not. Use AI, consolidate services and subscriptions, utilize freelancers, interns, etc. Once you have figured out your expenses, and profit margins, share the actual profits and profit margins.

2) How much are you paying your personnel including the founders?

3) What is your burn rate monthly/annually? (Monthly subscriptions, website hosting, office space, personnel costs, etc all added up)

4) What are the costs involved in customer acquisition? (CAC)

5) Explain your overhead on production or licenses, if any.

6) What are your costs for holding warehouse stock of your product, if any?

7) What are your expected net EBITDA revenues five years in?

7) Competitive Analysis & Advantage

It’s really important for you, your customers, and potential investors to be able to distinguish the difference between you and your competition.

When you have a great product that’s being offered, it’s highlighted even better when you can positively contrast it to your competition in both your executive summary and on your website.

Answer the Following Questions:

1) Who are your competitors?

2) What are the differences between you and your competitors?

3) What’s your competitive advantage over your competition?

4) Will it be easy or difficult for your competitors to adapt their product/service to eliminate your competitive advantage over them? Why and why not?

5) How will you show your competitive advantages to your target market?

6) How large are your competitors’ social media and online presences and can they easily outcompete you?

Section Tips:

- Include a table that clearly shows differences between you and your competitors and don’t be afraid to widen the page margins to make it fit. You can also display the page horizontally

- Slight or marginal advantages are going to make your startup look weak. Show why you will rise above them all.

- Patents and intellectual property rights are a part of what can make your startup more competitive, however, you still have to show how you’re going to execute your competitive advantages in your business model.

8) Management

Writing a powerful management section is a really important aspect of an executive summary when presenting this document to investors.

It’s important for investors because they don’t just invest in startup ideas, but they also equally invest in the team behind the startup and the vision.

Investors want to know that if they invest in your startup, their investment will have a great likelihood of growing to its fullest potential.

When submitting an executive summary to investors, the purpose of this section is to give investors confidence in you and your teammates.

Co-Founders

If you don’t have any co-founders yet, then it’s highly suggested that you find at least one.

You’ve probably heard of the saying “two heads are better than one.” You can accomplish so much more by having a co-founder. And, investors want to see that the team has between two and three co-founders, but sometimes four.

You can find an in-depth article we wrote on this subject here: How to Find a Co-Founder and What to Look For.

Furthermore, in the first section of our article How to Create a Startup Culture of Excellence, we also discuss the traits and values that are important when trying to find a co-founder that will be a great match for your team.

Remember, having a strong team to enhance your ability to raise capital will make your executive summary that much stronger.

Investors are far less likely to invest in a startup with one founder than with two or three. This is because the magnitude of difficulty is very high to be able to successfully implement everything in your startup on your own.

Questions/Topics to Answer:

1) Who on your team is going to do what? Explain the roles of your teammates.

2) Why is your team uniquely able to address this market problem and challenge?

3) What is your experience with startups as a founder managing startups and managing people?

4) What experience do your teammates and you have? Mention notable companies either of youh ave worked for and any major successes.

5) Who are your key advisors or mentors, if any?

9) Investment Size, Investment Expectations for Investor ROI, and Payback for Investors

To complete this section, you’ll need to answer the questions below:

1) How large is the investment you’re looking for and for how much equity?

2) What are you looking for from an investor? Just their money or their resources and connections?

3) What do you expect to use that investment towards? Break it down.

4) What will the money give you the ability to do?

5) How are you going to pay them back? Define your payback options.

Section Tips

- Some payback options are:

- Giving investors a percentage of sales until they make their money back

- Equity is another common form of payment via common stock or preferred stock

- Equity plus a percentage of sales revenue per sale

- Repayment via large/small chunks on a quarterly basis

- 5x or 10x ROI after a number of years (the higher the ROI the better)

- Many times startups seek more than just the investment they’re looking for.

- Startups are also seeking what else the investor can contribute. Some of these contributions can be their knowledge, their network, their experience within your target niche/product field, and even their active participation by them with you to make your startup more successful.

Conclusion

Writing an executive summary for your startup isn’t just important for your investors, but it’s important for the development of your startup. The work you put into making an executive summary now will pay dividends later because executive summaries cover the most important aspects of your startup and what you plan to do with your business.

And, if you want to move forward with writing a business plan eventually, you’ll have the core fundamentals of it where you can continue to build upon each section with more detail.

Just make sure that you’ve validated your startup before you write a full executive summary so you don’t waste your time.

And in the spirit of not wasting time, I encourage you to read Why Learning About Startup Failure is Critical to Success so you can continue your path towards success. Best of luck!

What are you using your executive summary for? For investment or for building your foundation? (Scroll all the way down to see the comment box)

One Response

The article was rather catching and intriguing enough to get all possible nuances to remember. I do enjoy reading the content and the writing mode of the author, etc. I advise you to write such sorts of articles daily to give the audience like me all of the necessary information. In my view, it is better to be ready for all the unexpected scenarios beforehand, so thanks, it was pretty cool.