Have you ever wondered if there were prerequisites to raising venture capital? Raising venture capital (VC) for startups is both an art and a science. It needs to be done strategically, with confidence, a great degree of preparation, and tactical salesmanship. In this article, we’re going to talk about the strategy and preparation that will put yourself in a better position to succeed in raising venture capital.

Ever since the funding bubble burst in late 2022/early 2023, investors have been seeking fiscally sustainable companies. Meaning, they want to make sure you can pay for your expenses and still turn a profit. For far too long, investors took larger risks than they now realize they should have, putting their money into companies that weren’t profitable, and/or had a good team but little to no traction to show for it.

Yet, traction is not the only thing that they care about. In fact, it’s just one of many factors that we’ll discuss in this post. We’ll discuss what startups need to have with their product/service before raising venture capital. Additionally, this post will help startups like you avoid the mistakes that waste time and money when going after funding prematurely.

By the end of this post, you’ll have learned what’s needed to confidently know when you’re actually ready to start the process of seeking and raising investment.

We’ll Go Over:

- Preamble

- The nature of the venture capital industry

- What raising venture capital actually does for a startup besides getting money

- The success and failure of venture capital funded startups

- What startups need before they fundraise

- How traction is measured, and how to show it to investors

- Methods of getting traction before raising venture capital

- Idea Validation

- MVPs

- Product-market fit

- The intangibles of startup growth

- Conclusion

Preamble

Startups often approach raising venture capital prematurely by attempting to talk to investors about their idea, but don’t have anything concrete to show them. Many think they have the next billion-dollar startup idea, but they have nothing to show for it because it’s just an idea. There are so many startups that try to get funding before they’re actually ready to get it and wind up feeling disappointed from the rejections and they waste their time as a result.

Investors who might be slightly interested will often email you back telling you that they need to see more traction before they can move forward in any way with you. This is one of the first things that I learned when trying to pitch an idea to them in 2007 before the tech scene started exploding.

Pre-seed investment and angel investing are basically the onlys way to get traditional funding (without a traditional accelerator) for a startup idea. And even then, there has to be something else besides the idea that’s attractive.

One thing is for sure – if an angel investor, accelerator, or VC firm that provides pre-seed funding, you better have at least validated your startup idea and have the data to back it up. Startup funding has become a lot more disciplined by investors. But this doesn’t preclude you from taking other approaches to startup funding.

The Nature of the Venture Capital Industry

The best way for me to tell you what is important to have before raising capital to is to first explain the nature of venture capital itself so you can understand a venture capitalist’s perspective. This also helps us better understand the venture capital investment process.

Venture capitalists generally manage venture funds which consist of a combination of other people’s money and their own that was raised by the VC firm. Sometimes they don’t have any of their own money in it. However, the fund is usually used for specific types of investments in startups by industry.

The fund’s success is their success and naturally, they want to get a return on their investment. Venture capitalists want to see a big ROI.

We’re not talking a 2x or 3x return on investment. We’re talking of between 5x and 15x ROI via a private buyout of shares or an IPO (initial public offering) on the stock market.

Moreover, it’s important to understand that venture capitalists want to make a lot of money, so they don’t place investments in startups that cater to a small market.

Investors also want to invest in startups whose total addressable market (TAM) is in the hundreds of millions, to billions of dollars.

So if you don’t have a large enough market, then traction isn’t going to do anything for you in landing venture capital.

What Does Venture Capital Actually Do for a Startup?

Let’s start with analogies with startups, VC, cars, and racing.

Your startup’s product or service is like an engine. Marketing, which includes sales, is like the fuel that keeps the engine running.

Venture capital investment is like nitrous oxide, a turbo-charger, and/or a high-octane fuel. It allows you to scale up your marketing operations and add more key teammates so your company can make even more profit.

Fuel cannot work if there’s isn’t an engine. So if you don’t have a product or service, then marketing won’t work unless you’re doing a pre-launch waiting-list. And VC investment isn’t really going to do any good anyway because it’s meant to speed up real traction with a real product or service.

Venture capital investment only works when you have a functioning startup behind it that’s marketing. If your startup isn’t marketing, then rocket fuel won’t help. Moreover, venture capitalists can be utilized way better than just entering into a transactional relationship for money.

VCs are people too, and they have usually have experience and wisdom from the startup and tech industries. In addition, they have connections and resources who they can connect you with.

Are you a founder of an early-stage pre-seed or bootstrapped company?

Get strategies, tactics, and processes to help you build and grow your startup through our 45-lesson accelerator program and our startup resource platform. Gain insights to help you avoid mistakes that cause other startups to commonly fail and use tested strategies we share to help you grow into a world-class company.

*If you have not validated your startup idea yet, this program is not for you, but our Incubator Program is.*

14-day free trial are available. No credit card required.

The Success and Failure of Venture Capital Funded Startups

Did you know that between 10-30% of startups who raise venture capital investment are actually successful?

This means that most of the startups they invest in are failing and the firm will often never see any ROI to replenish the fund’s coffers unless there’s a small buyout or liquidation.

Think about it — they are taking a big risk by investing in any startup because there are so many unknowns. Markets change, teams change, and plans don’t always work out like expected. Timelines often get expanded due to unforeseen delays, personal life crises occur, and more.

Startups are volatile.

VCs need to hedge the risks of investing and make sure they’re making a smart investment because once the deal is done, it’s done and there’s no going back. It’s not like stocks which you can buy and sell at a moment’s notice while trading is open.

Now that we understand the point of view of the VC investor, we’re then able to see why they generally won’t invest in some unproven idea.

This is true for a lot of pre-seed firms, as well. While they will invest in some ideas before a product, they’re taking huge risks by doing it and they will want to at least see a great team behind the idea.

Makes sense, right?

What Startups Need Before They Fundraise

Little do new startups know that the venture capitalists either won’t respond back to them or they get a response telling them to get traction before they’ll consider investing in their startup. I experience this over ten years ago myself and have heard it time and time again from other startups since then who talk of this.

Traction is one of the first things investors look for in startups and it’s a sign that your target customers actually want your product or service. Traction is also a sign that your startup idea has merit.

Doesn’t it make sense that investors would want to see startups have consistent traction in their market before they take the risk to invest?

It’s important to make sure your idea has merit, and if you don’t know if it does, check out our guides how to start a startup and how to validate a startup idea, or join our Incubator Program so that you can learn how.

You’re also going to want your startup to have product-market fit. It’s the holy grail of startups that every $1B unicorn has.

There’s a process that you’ll need to take to help you get there. If you want to learn more about it, I suggest reading this guide on product-market fit with everything you need to know.

Startups need a strong team, a validated startup idea, time, resources, money, and an insatiable drive to succeed, even when the going gets tough.

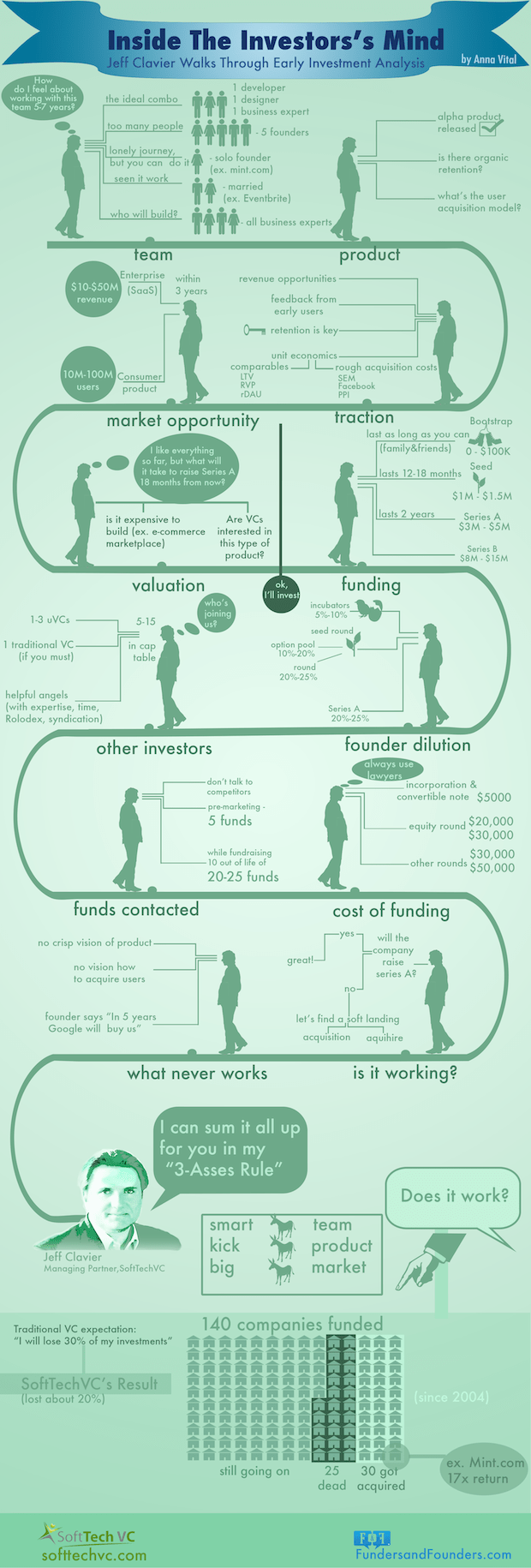

But what else do VC’s look for? Here’s another helpful infographic for you learn from.

In the next section, we’ll talk about measuring traction and how you can show its validity to investors.

What is Traction and How is it Measured?

Traction is the attainment of users, whether paid or not (paid is obviously way better), to show proof of your concept.

Traction is the most meaningful validation of your idea through the acquisition of users and sales.

This means you need some sort of product or service, whether it’s a minimum viable product or a minimum valuable viable validating product, as Guy Kawasaki suggests, which is even better.

However, there’s no industry bar or standard of what traction looks like for each startup. But you can point to percentage increases in week over week (WoW) and/or month over month (MoM) growth as some very important key performance indicators to measure growth.

Using percentage increases are a far better gauge for KPI effectiveness than telling you that yourself that you need 500 or 6000 users or whatever to say you have traction. However, large numbers of users is also important in gauging traction.

30-50% month over month (MoM) growth is quite good. 20% MoM growth is solid too. But the more users you get, the lower those percentages will become.

What’s more, setting and reaching the milestones you set for your startup will also be helpful for you so you can reverse engineer your goals. This allows you to create your plan of how you’re going to reach them.

You’re going to want to show venture capitalists how you’ve created your traction and the data to support it.

The Team

Not only is traction necessary, but so is a good team. However, if you have traction and are a solo founder, then you may still be able to get funded. But if you have no traction and an amazing team of serial founders with great experience, then investors may overlook your lack of traction if you’re pre-product and trying to raise a pre-seed or seed round.

The team is a quintessential part of a startup, and it’s hard to have a company of one for a while and still be able to grow. Sure, you can outsource, but it’s only going to get you so far. And eventually, you’ll need your own team that you can rely on and vice-versa.

To put this into perspective, to get into many physical startup accelerators, having a team of minimally two people with a developer on board is practically a requirement.

When you ask investors what they look for in a startup, at least half the time they will say, a great team.

And it’s because the team is going to be comprised of the people who drive your startup’s traction forward. These will be both emotionally and intellectually intelligent.

Embedded in your team, needs to be a company culture that is positive, welcoming, and empowering.

You’ll all need to work together, not siloed, so that you can coordinate cross-functional activities and mutually support each other’s individual growth and the growth of your company.

When you can put together an all-star team of people with proven track records, venture capitalists are going to be SO much more likely to want to jump on board your company’s fundraising wagon.

Methods of Getting Traction Before Raising Venture Capital

From the very beginning of your startup, validating or invalidating your idea will give you a good understanding of how well it gains traction because, in order to validate your idea, you’ll have to contact your target customers and build relationships with them.

When you do that, and if they like what you’re telling them, then they’ll probably become your earliest customers and evangelists, as long as they’re willing to pay for it.

Idea Validation Prevents Disaster and Increases Investor Confidence

42% of startups fail because they make products that nobody want. You and I both know that you don’t want to screw up your startup, so your options are to either validate or invalidate your startup idea and vision for it.

Investors will be much more confident about investing in your company if you’ve gone through a rigorous idea validation process. When you tell them, this helps de-risk the investment and increases their confidence that you will be building something of value and staying power in the market.

You can learn how to validate your idea for free, or via our Incubator Program via a free trial and cost-effective membership subscription.

The program is much more in depth, and you can validate or invalidate a your startup idea so that you don’t make the same mistake as the 42% who fail.

It provides an extensive idea validation course and helps your startup or potential startup to build a strong foundation to develop your company on. Our Incubator Program will also provide you with all of the questions you’d probably ever need to help you get meaningful feedback from potential users.

But perhaps you didn’t really validate it before building your product/service.

In that case, you should make sure that you work with as many of your users as possible to find out what they want and how your startup can help them solve their problem(s). Moreover, don’t pivot until you have the feedback, and until your users essentially give you the go-ahead to pivot and build something that better solves their problems and delights them with your solution.

Building a Minimum Viable Product

What’s more, you’ll continue to work on building traction after you’ve built your minimum viable product (MVP).

In the following article, I show you how to build a minimum viable product and you can also refer to Guy Kawasaki’s advice on improving an MVP to become an MVVVP here.

With your MVP, you can start marketing it more, especially on social media. StartupDevKit has loads of great startup and marketing content to help you with growth so you can keep building traction.

Product-Market Fit

As you work to build traction, you’ll be simultaneously working to reach product-market fit (PMF).

From this article I wrote, you can find out what product-market fit is, why you need it, and how to get it.

Working towards PMF is a constant exercise of building traction and achieving greater growth. So if you want to raise venture capital investment or just have a successful startup, then achieving product-market fit should be a priority.

The Intangibles of Startup Growth

Every startup has its own different and unique challenges in its efforts to gain traction.

It often takes a lot of experimentation before you find out what works really well for you.

That’s why when you perform at least four simultaneous experiments per month, you’ll have a much greater chance of finding out what works and what doesn’t. One or two experiments per month just isn’t enough.

Startups have to measure and test practically everything they do so they can become their best version of their company.

It requires a laser focus on the activities that are going to be the most meaningful for your business and discarding the ones that don’t help you build traction.

Find what works and what doesn’t so you can concentrate on what works and concentrate on startup growth and get the traction needed for raising venture capital.

What Else You Need – Time and a Data Room

The typical fundraising round take three to six months to occur. It’s considered a nearly full time job to raise a full round of capital. So make sure you have time to devote. The CEO is the one who leads the charge for raising a round.

When you’ve achieved traction, and you’re ready for funding, you’ll need a data room, which is essentially a cloud-based folder that stores all of your important files that you’d share with investors. If you’re going for a pre-seed round, or angel investment, then you’ll need fewer documents, but the higher the round, the more due diligence that will occur and the more info you need.

Your materials should be organized by categorical folders:

- Overview

- Financials

- Cap table and financing

- Market Data

- Incorporation docs

- Team and stakeholders info

- Customer References

- Sales and Marketing

- Product

The Basic Documents:

- A pitch deck

- An executive summary

- A business plan (the plan can be split into different documents and in different folders for the purposes of the data room)

Conclusion

The moral of this story is, you guessed it: startup should be getting traction before raising venture capital investment – especially seed-stage capital.

Trying to do it the other way around is just going to waste time and credibility. Save time and energy for better things, like gaining traction.

However, the methodologies you use to gain traction is up to you.

Check out the next article in the series of fundraising articles: How to Raise Venture Capital for Early-Stage Startups and 13 Ways to Fund Your Tech Startup

What have been your experiences with investors? Share your thoughts and experiences in the comments below!

2 Responses

As a software solutions architect, a startup scholar and practitioner in an ermeging ecosystem, I am truly intrigued by the insight you provide. I am certainly reading a lot about how to commercialize technology start-ups and will use you authoritative insights on how to practically incorporate this in my current work with startups.

Thanks Kamulegeya! I’m happy that you found the article helpful for you!