If you’re like most founders, you probably want to raise money for your startup. But even if you don’t, there are many ways to fund your startup that don’t require investors and for you to give up equity. We’re going to show you the different ways to fund your startup, what they’re about, how much companies raise for each method of funding, and what the pros and cons are for each of them.

Funding Your Startup Business

There are many ways of funding your startup business, but it’s important to note that only 0.05% of startups raise venture capital. It’s not easy but it’s not impossible, so you must come prepared for the challenge.

But hey, that stat doesn’t mean you can’t fund your startup in different ways!

However, it’s crucial to point out that you invest some of your own seed money into starting the business, otherwise you’ll be completely strapped for cash. You’ll need between $5,000 and $10,000 USD to start your company with. But you’ll also need to maintain a job while you gain traction to turn it into a full-fledged company unless your partner, parents, or spouse can financially support you.

Running out of cash is the #1 reason why startups fail (it moved up from #2), as per CB Insights.

The #2 reason why startups fail is making products that too few want.

So before you start trying to raise any money, rigorously validate your startup idea.

Our idea validation course in our incubator program can help you with that.

But whether or not you’ve validated your startup idea yet, it’s still important to understand the different ways to fund your startup to make better decisions.

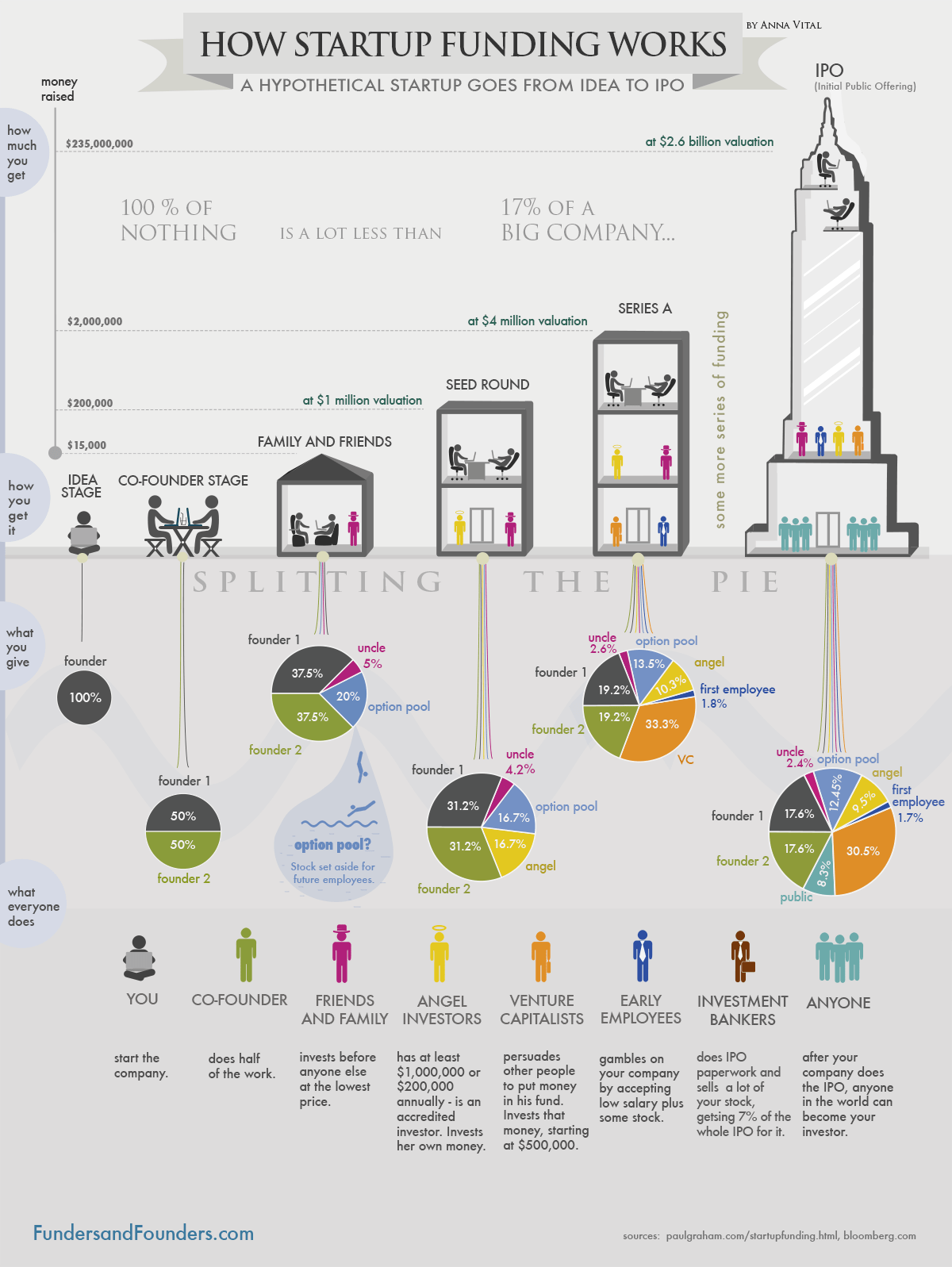

Using four of the sources of funding that we share in this post, this infographic provide you with an idea of the trajectory of a startup.

1. Do Friends and Family Fundraising to Initially Fund Your Startup

If you’re just kicking off your startup journey, tapping into your personal network can be an invaluable source of initial funds. Friends and family fundraising involves seeking financial support from those closest to you who believe in your vision. In fact, it’s the most common way to start funding a startup business, offering a more informal and flexible approach to financing.

Friends and family fundraising is like a financial trust fall – those who know you best will likely invest in your idea or donate to you. They may provide loans, gifts, or even purchase shares, but it’s crucial to maintain transparency about the risks involved. That’s because 90% of startups fail, so there is a high risk of the business going under.

How much companies raise: Amounts can vary widely, ranging from a few thousand to several hundred thousand dollars. It often depends on the personal financial capacities of your network.

Pros and Cons

Pros:

- Quick access to initial capital.

- Flexible terms and potentially lower interest rates.

- Support comes from people who believe in you personally.

Cons:

- Strain on personal relationships if things don’t go as planned.

- Limited pool of funds compared to institutional investors.

- Potential for misunderstandings if expectations are not clearly communicated.

Remember, when reaching out to friends and family, it’s essential to approach it professionally. Clearly outline the terms of the investment or loan and be honest about the risks involved. This early support can be a critical stepping stone for your startup.

The best outcome with friends and family fundraising is to receive the money raised as gifts. This way, you will not be expected to provide anything in return. And, donations are not taxable (at the time of writing).

How to Approach Friends and Family for Donations

- Call or meet up with your friends or family. Tell them you’re starting a new business and tell them your idea

- Share with them why you’re personally pursuing this idea and why it means something to you.

- Will it potentially make a positive impact on the world? If yes, then you need to share this!!

- If the person you are asking makes good money, ask them if they’d be comfortable making a donation of $200 or $150. If they don’t make much, ask for a smaller contribution of $25 or $50 dollars.

- Share why you need the money and share a simplified plan for how you will use the money.

- Tell them how much it would mean to have their support.

- If they agree to donate, thank them wholeheartedly. Mention that you will share updates with them if they like. You can BCC them with personal email updates. Or, you can ask them if they’d like to be added to your email list for updates.

- Referrals: Ask if they know anybody who might be interested in using your product/service, who might be of help in your journey, or who might be interested in investing.

- Send them a thank you card, no matter what the donation amount is.

2. Angel Investment

Now, let’s delve into the world of angel investors – individuals who are not just financially savvy but also seasoned entrepreneurs looking to support promising startups.

They inject capital into your business in exchange for equity, offering not just funds but also mentorship, their network, and industry insights.

How much companies raise: Angel investments typically range from micro-investments starting at $5,000 and can go up to $500,000, depending on the investor and the stage of your startup. They often fill the gap between friends and family funding and larger venture capital rounds.

Equity provided: The equity provided can vary, but it often falls within the range of 5% to 25%. Micro-investments may result in a slightly higher equity stake due to the smaller amounts involved.

Approximate Equity per Amount Raised:

- $5,000: 5% – 8%

- $10,000: 7% – 10%

- $25,000: 10% – 15%

- $50,000: 12% – 18%

- $100,000: 15% – 20%

- $250,000: 18% – 22%

- $500,000: 20% – 25%

Pros and Cons

Pros:

- Access to experienced mentors and industry connections.

- Angel investors bring valuable expertise to the table.

- Relatively quicker decision-making compared to institutional funding.

Cons:

- Giving up equity means sharing ownership and decision-making.

- Finding the right angel investor can be time-consuming.

- Expectations for rapid growth and return on investment may increase.

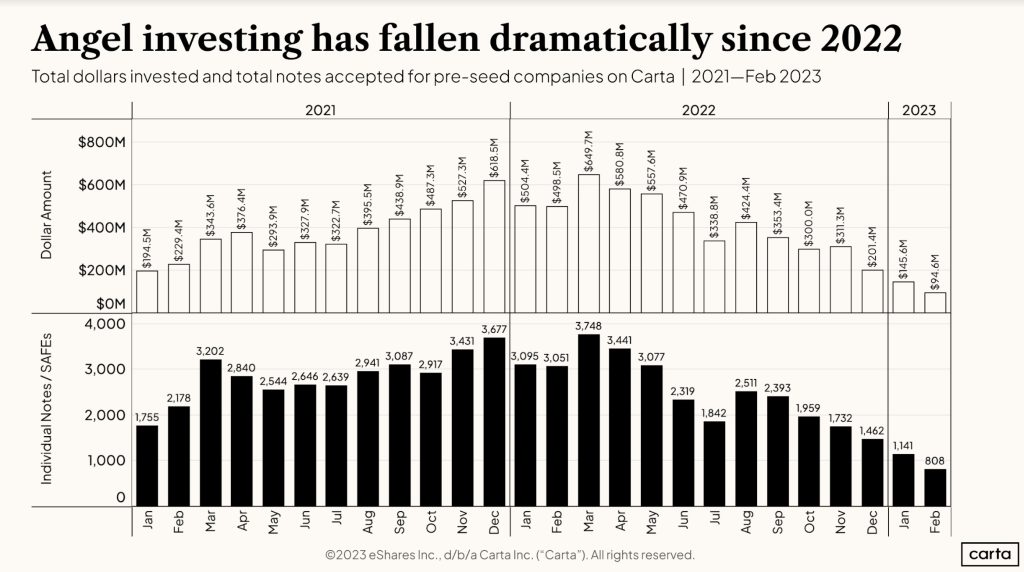

When seeking angel investment, it’s crucial to showcase not only your business idea but also your team’s capability to execute it. These investors often look for startups with high growth potential and a clear path to profitability. This is even more apparent by the total dollars invested in 2023, as it dropped to levels lower than it ever has the past two years. Angel investors want to see both potential and traction.

3. Venture Capital

Venture Capital (VC) is like the heavyweight champion of startup funding, injecting substantial amounts of capital into high-potential companies in exchange for a significant stake.

VCs manage pooled funds from various investors, including institutions and high-net-worth individuals. They seek startups with explosive growth potential and are willing to take calculated risks for substantial returns. Startups with two co-founders rather than one raise 30% more capital. And of startups that raised seed rounds, 1% reached unicorn status of $1B+ valuation.

How much companies raise: Venture capital rounds vary based on the startup’s stage:

- Pre-Seed: $100,000 – $1 million

- Seed: $1 million – $5 million

- Series A: $5 million – $25 million

- Series B: $25 million – $100 million

- Series C and beyond: $100 million+

These funds are often used to scale operations, expand market reach, and accelerate growth.

Equity provided: In return for the substantial investment, venture capitalists usually take a significant equity stake, ranging from 20% to 50%. The exact percentage depends on the valuation of the startup and negotiation between both parties.

Approximate Equity per Amount Raised:

- Pre-Seed: 15% – 25%

- Seed: 20% – 30%

- Series A: 25% – 35%

- Series B: 30% – 40%

- Series C and beyond: 35% – 50%

Pros and Cons

Pros:

- Access to substantial capital for rapid expansion.

- Expert guidance from experienced investors.

- Opportunities for networking and partnerships within the VC ecosystem.

Cons:

- Dilution of founder ownership due to significant equity stakes.

- High expectations for rapid growth and exit strategies.

- Rigorous due diligence process and longer decision timelines.

Venture capital is a game-changer for startups aiming for explosive growth. However, founders should carefully consider the trade-off between capital infusion and ownership percentage.

Investment is judged by many factors.

The most common criteria of startups who receive capital have a:

- Strong team of highly capable and accomplished individuals who have minimal skill overlap

- Startup that fills a market need

- Strong traction

- Recommendations and/or introductions from people who know VCs

If you want to gain insights into the minds of venture capitalists, their words are usually best, so check out these 20 Venture Capital Blogs You Absolutely Have To Read.

You will also benefit from reading:

- Raising Venture Capital: What Startups Need Before Fundraising

- How To Raise Venture Capital For A Startup

Where to find investors:

Our favorite investor platform to refer founders to is Signal by NfX Capital. There are other platforms, but that’s for another post.

4. Incubators and Accelerators

Imagine a high-powered training ground for startups – that’s what incubators and accelerators provide. These programs offer a blend of funding, mentorship, and resources to catapult your startup into the fast lane.

Incubators and accelerators are organizations designed to nurture early-stage startups. Incubators focus on providing a supportive environment for fledgling businesses, while accelerators are like boot camps, offering intensive mentorship and a more defined timeline.

Some incubators and accelerators do not provide funding, but they also don’t take any equity either, like us at StartupDevKit. Instead we are virtual, and provide a range of learning materials and resources to simplify and amplify your startup journey through courses and our platform with boatloads of resources.

Anyway, back to the ones that fund your startup!

How much companies raise: Funding in incubators can range from $20,000 to $100,000, while accelerators typically provide funding in exchange for equity and can range from $50,000 to $500,000. The key difference lies in the level of support and the speed at which it’s delivered.

Equity provided: In incubators, equity is usually lower, ranging from 5% to 10%, as they offer more general support. Accelerators, with their intensive programs, often take a higher equity stake, typically ranging from 5% to 20%.

Approximate Equity per Amount Raised:

- Incubators: $20,000 – $100,000: 5% – 10%

- Accelerators: $50,000 – $500,000: 5% – 20%

Pros and Cons

Pros:

- Access to a structured program with mentorship and resources.

- Networking opportunities with industry experts and fellow startups.

- Accelerated growth due to focused support and guidance.

Cons:

- Higher equity stakes in accelerators.

- Competitive application process.

- Limited time to prove your business viability.

Choosing between an incubator and an accelerator depends on your startup’s needs. Incubators suit those requiring a more relaxed pace, while accelerators are perfect for those ready to sprint toward growth.

Check out The 50 Best Startup Incubators & Accelerators in the USA

5. Crowdfunding

Ever wished your customers could also be your investors? Crowdfunding makes that dream a reality. This method involves raising small amounts of money from a large number of people who believe in your product or vision.

Crowdfunding platforms, such as Kickstarter or Indiegogo, allow entrepreneurs to showcase their products or ideas to a vast online audience. Contributors, or backers, pledge funds to support the project, often in exchange for early access, discounts, or other perks.

How much companies raise: Crowdfunding campaigns can range from a few thousand to millions of dollars, depending on the project’s scope and the level of interest it generates from backers.

Equity provided: In traditional crowdfunding, backers don’t receive equity in the company. Instead, they get rewards or early access to the product or service. Equity crowdfunding, discussed in the next section, is where backers receive a stake in the business.

Approximate Equity per Amount Raised:

- Traditional Crowdfunding: No equity provided; backers receive rewards.

- Equity Crowdfunding: Discussing this in the next section.

Pros and Cons

Pros:

- Direct engagement with your customer base.

- Validation of product demand and market interest.

- No equity dilution, as backers receive rewards, not ownership.

Cons:

- All-or-nothing model (if campaign goals aren’t met, no funds are received).

- Intensive campaign management and promotion required.

- Shipping products or fulfilling rewards can pose logistical challenges.

- You will need two months of preparation and pre-launch marketing.

Crowdfunding is not just about raising funds; it’s a marketing and validation tool. It allows you to test the market and build a community around your product before it even launches.

If crowdfunding is of interest to you, see the top eight non-equity crowdfunding platforms below.

The top non-equity crowdfunding platforms are:

- Kickstarter: One of the most popular crowdfunding platforms, Kickstarter allows creators to raise funds for creative projects, including films, music, art, technology, and more. Backers contribute funds in exchange for rewards, such as early access or exclusive merchandise.

- Indiegogo: Similar to Kickstarter, Indiegogo caters to a wide range of projects, from tech gadgets to films and charitable causes. It offers both fixed funding (all-or-nothing) and flexible funding (keep what you raise) options for campaigns.

- GoFundMe: While often associated with personal fundraising and charitable causes, GoFundMe is also used for entrepreneurial ventures, medical expenses, and creative projects. It operates on a keep-what-you-raise model, and contributors typically don’t receive equity.

6. Equity Crowdfunding

Equity crowdfunding takes the crowdfunding concept a step further, allowing backers to become actual shareholders in your startup. It’s like inviting a crowd of investors to collectively own a piece of your business.

Equity crowdfunding platforms, such as SeedInvest or Crowdcube, enable startups to raise capital by offering equity to a large number of investors. Instead of traditional investors providing large sums, numerous individuals contribute smaller amounts in exchange for shares in your company.

How much companies raise: Equity crowdfunding campaigns can range from tens of thousands to several million dollars, depending on the platform, the startup’s valuation, and investor interest.

Equity provided: In equity crowdfunding, backers receive a share of ownership in the company. The amount of equity given is determined by the valuation of your startup and the amount invested by each backer.

Approximate Equity per Amount Raised:

- Varies: Equity provided is based on the valuation of your startup. As a rough estimate, for a $1 million campaign, equity offered might be around 10% to 20%.

Pros and Cons

Pros:

- Access to a diverse group of investors.

- Broadens the pool of potential backers beyond traditional venture capitalists.

- Provides an alternative to traditional funding methods.

Cons:

- Dilution of ownership as multiple investors hold shares.

- Ongoing communication and reporting requirements to a larger group of shareholders.

- Legal complexities and compliance with securities regulations.

Equity crowdfunding democratizes investment, allowing a wider audience to become stakeholders in startups. However, it comes with the responsibility of managing a larger and more diverse group of investors.

And, it comes with many legal requirements, which you can get a hint of below.

Legal Requirements:

- Securities Regulations: Compliance with SEC regulations in the U.S., including necessary filings.

- Due Diligence: Thorough vetting of business, financials, and risks prior to crowdfunding launch.

- Investor Limits: Adherence to country-specific limits to protect smaller investors.

- Platform Registration: Mandatory registration with financial regulatory authorities.

- Financial Audits: Required for startups raising substantial amounts for added transparency.

- Communication and Reporting: Ongoing transparent communication and regular reporting to investors.

- Exit Strategies: Clear documentation outlining potential methods for investor returns.

Before diving into equity crowdfunding, it’s crucial for startups to consult legal professionals specializing in securities laws. Understanding and complying with these legal requirements not only ensures a smooth fundraising process but also builds trust with investors.

Top Equity Crowdfunding Platforms

- StartEngine: Positioned as one of the largest equity crowdfunding platforms in the U.S., StartEngine supports a variety of businesses and has facilitated significant fundraising campaigns.

- Republic: Republic is known for its focus on democratizing investing by allowing both accredited and non-accredited investors to participate in crowdfunding campaigns.

- Wefunder: Wefunder is a U.S.-based platform that emphasizes helping startups raise funds from a wide range of investors, including non-accredited individuals.

7. Pre-Order Campaigns for Your Product

Imagine getting paid before your product even hits the market – that’s the beauty of pre-order campaigns. This funding method involves offering your product for sale before it’s officially launched, allowing you to secure funds and validate demand.

What it’s about: Pre-order campaigns leverage the excitement around your upcoming product. Customers pay in advance to secure their order, providing you with the necessary capital to manufacture or develop the product.

How much companies raise: The funds raised through pre-order campaigns can vary widely, from a few thousand to millions of dollars, depending on factors like the product’s popularity, pricing, and marketing efforts.

Pros and Cons

Pros:

- Generates early revenue and cash flow.

- Validates market demand for your product.

- Provides crucial funds for manufacturing or development.

Cons:

- Risk of overpromising and underdelivering.

- Pressure to meet production timelines and quality expectations.

- Potential reputational risk if the product faces delays or issues.

Tips for Success:

- Clear Communication: Be transparent about the product’s development stage, expected delivery timeline, and any potential risks.

- Incentives: Offer attractive incentives for early backers, such as exclusive discounts, limited edition versions, or additional perks.

- Marketing Strategy: Utilize effective marketing strategies, including social media, email campaigns, and partnerships, to create buzz around your pre-order launch.

- Quality Assurance: Ensure that your product is well-tested and that you can meet production demands. Customer satisfaction is crucial for the success of future ventures.

Pre-order campaigns are not only a funding source but also a powerful marketing tool. They allow you to engage with your target audience, build anticipation, and turn potential customers into advocates for your brand.

8. Self-Funding or Bootstrapping

Bootstrapping is the best path if you want to maintain full control over your company, but it’s often the slowest path to growth, as well. Bootstrapping your company like Mailchimp did could lead to a massive payday if you succeed in building a highly successful company and then sell it.

In this situation, you self fund your startup by using what you earn with your day job and/or from savings. In addition, you and your partner(s) would have to determine how much each of you put into the company each month. The equity that one person gets may be more if one person puts in a considerably larger amount of money into the business.

You also bootstrap by reinvesting all of the money your startup earns, right back into the company. That money usually goes towards paying for services, agencies, subscriptions, freelancers, employees, ads, marketing, product development, etc. Therefore, you wouldn’t get paid until your startup becomes sustainable and makes enough profit to do so.

Pros and Cons

Pros:

- Full control and ownership of your business.

- No need to share profits or decision-making with external investors.

- More flexibility and less time spent seeking funding.

Cons:

- Limited resources may slow down growth.

- Personal financial risk is higher.

- Challenges in scaling quickly without external capital.

Tips for Success:

- Frugality: Embrace a frugal mindset by prioritizing essential expenses and avoiding unnecessary costs.

- Profitability Focus: Aim for profitability early on to generate funds from your business operations.

- Strategic Growth: Plan for strategic and sustainable growth rather than rapid expansion.

- Diversification: Consider diversifying revenue streams to enhance financial stability.

Self-funding requires a strong belief in your business and a willingness to patiently grow it over time. Sometimes business owners need that flexibility. While it may limit the speed of expansion, it provides a solid foundation built on your terms.

9. Government Grants

If you’re looking for non-dilutive funding, government grants can be a valuable resource. These grants are offered by government agencies to support specific industries, research, or initiatives that align with their objectives.

Government grants are financial awards provided by government agencies to businesses or individuals. These funds are typically aimed at fostering innovation, research, job creation, or addressing specific societal needs.

How much companies raise: Government grant amounts vary widely depending on the program and its objectives. Funding can range from thousands to millions of dollars.

Pros and Cons

Pros:

- Non-dilutive funding: No equity is given up in exchange for the funds.

- Validation: Being awarded a government grant can validate the viability and importance of your project.

- Access to expertise: Some grant programs offer additional benefits, such as mentorship and access to government resources.

Cons:

- Competitive: Government grants often involve a competitive application process.

- Stringent criteria: Grants may come with specific requirements and expectations.

- Lengthy approval process: The application and approval process can be time-consuming.

Tips for Success:

- Thorough Research: Identify and apply for grants that align with your business goals and objectives.

- Professional Assistance: Consider seeking assistance from grant writing professionals to enhance your application.

- Compliance: Ensure your project meets all the criteria outlined in the grant application.

Government grants can be a substantial source of funding, especially for startups engaged in research, innovation, or projects aligned with government priorities. Researching and navigating the application process diligently are key to maximizing your chances of success.

10. Competitions

If you’re up for a challenge, entering entrepreneurial competitions can not only bring recognition but also provide substantial financial rewards. Many organizations and institutions host competitions to discover and support innovative startups.

Entrepreneurial competitions invite startups to pitch their ideas or showcase their products to a panel of judges. These competitions can be sector-specific, focusing on technology, social impact, or general entrepreneurship.

How much companies raise: Prize amounts in entrepreneurial competitions can range from a few thousand to several million dollars, depending on the scale and prestige of the competition.

Pros and Cons

Pros:

- Financial Boost: Winning competitions can provide a significant cash injection.

- Networking: Opportunities to connect with mentors, investors, and industry experts.

- Validation: Recognition and awards act as a validation stamp for your startup.

Cons:

- Intense Competition: The competition can be fierce, with numerous startups vying for the prize.

- Time-Consuming: Preparing for and participating in competitions requires time and effort.

- Uncertain Outcome: Success is not guaranteed, and winning is subjective to the judges’ decisions.

Tips for Success:

- Tailor Your Pitch: Customize your pitch to align with the competition’s criteria and focus.

- Practice, Practice, Practice: Refine your presentation through multiple rehearsals.

- Research the Judges: Understand the preferences and interests of the competition judges.

Participating in entrepreneurial competitions is not just about the prize money; it’s an opportunity to gain exposure, refine your pitch, and connect with influential figures in your industry. Keep an eye out for competitions that align with your startup’s goals and values.

The Two Most Popular Competitions

- Tech conference pitch competitions

- Business or startup competitions by large corporate companies

Here are 25 of the Best Startup Pitch Competitions of 2024 [Virtual Friendly]

11. Private Equity

For those seeking substantial funding and strategic partnerships, private equity might be the avenue to explore. Private equity firms invest directly in companies, aiming to drive growth and eventually realize a return on their investment.

Private equity involves investors, often private equity firms or high-net-worth individuals, acquiring a significant stake in a company. This investment is typically made with the intention of actively participating in the company’s management and decision-making.

How much companies raise: Private equity investments can range from a few million to billions of dollars, depending on the size and stage of the company.

Pros and Cons

Pros:

- Substantial Funding: Access to significant capital for expansion, acquisitions, or restructuring.

- Strategic Expertise: Private equity firms often bring strategic insights and industry expertise.

- Long-Term Partnerships: Aiming for mutual success, private equity investors usually take a long-term approach.

Cons:

- Ownership Dilution: Significant equity is exchanged for the investment, leading to ownership dilution.

- Loss of Control: With new stakeholders, founders might experience a loss of operational control.

- Exit Strategy Pressure: Private equity investors typically expect a planned exit strategy, such as an IPO or acquisition.

Tips for Success:

- Alignment of Goals: Ensure your business goals align with the strategic vision of the private equity firm.

- Due Diligence: Research and choose a private equity partner with a track record in your industry.

- Clear Communication: Establish open communication channels to align expectations and avoid surprises.

Private equity can be a powerful tool for established businesses looking to scale rapidly or undergo strategic transformations. It’s crucial to choose the right partner and maintain a collaborative relationship to achieve shared success.

Business Loans

When it comes to traditional financing, business loans are a tried-and-true method for securing capital. Entrepreneurs can borrow funds from banks or financial institutions, providing flexibility in how the money is used for business needs.

Business loans involve borrowing a specific amount of money from a lender with the agreement to repay the loan along with interest over a predetermined period. These loans can be used for various business purposes, from working capital to expansion projects.

How much companies raise: Business loans can range from a few thousand to millions of dollars, depending on the financial health of the business, its creditworthiness, and the lender’s terms.

Pros and Cons

Pros:

- Control: You maintain full control and ownership of your business.

- Fixed Repayment: Predictable monthly repayments help with budgeting.

- Various Loan Types: Different loan options cater to specific business needs, such as term loans, lines of credit, and SBA loans.

Cons:

- Debt Obligation: The borrowed amount must be repaid with interest, adding a financial obligation.

- Qualification Criteria: Meeting the lender’s requirements, including a good credit history, is essential.

- Interest Costs: Interest payments increase the overall cost of the loan.

Tips for Success:

- Assess Your Needs: Clearly understand why you need the loan and how it will benefit your business.

- Shop Around: Explore different lenders and loan types to find the best terms for your situation.

- Financial Planning: Ensure your business can comfortably manage the repayment schedule without straining cash flow.

Business loans are a classic financing option, offering flexibility and control. Careful consideration of your business’s financial situation and a well-thought-out repayment plan are key to making the most of this funding method.

Given the instability of the startup environment and the high failure rate, a business loan would only be a good option for you to explore when you have significant revenue and profit coming in. A business loan would enable you to grow your operations quicker than with your cash on hand. But it is not recommended for new tech startups.

Credit Cards

Do you know how it’s said to save the best for last? Well, we’ve saved the worst for last. Credit cards can serve as a quick and flexible financing option for startups. Entrepreneurs can use business credit cards to cover expenses, manage cash flow, and earn rewards.

Business credit cards allow entrepreneurs to borrow money up to a predetermined credit limit. Cardholders can use the card for various business expenses, and they’re required to make minimum monthly payments, with the option to carry a balance (at an interest cost).

How much companies raise: Credit card limits vary based on the business’s creditworthiness, with limits ranging from a few thousand to several hundred thousand dollars.

Pros and Cons

Pros:

- Quick Access: Immediate access to funds for urgent business needs.

- Rewards Programs: Many business credit cards offer rewards, such as cashback or travel points.

- Flexibility: Use funds as needed without specifying the purpose to the credit card issuer.

Cons:

- High-Interest Rates: Credit cards often carry higher interest rates compared to other financing options.

- Personal Liability: Small business owners may be personally liable for credit card debt.

- Limited Credit: Depending solely on credit cards can limit overall credit availability.

Tips for Success:

- Responsible Usage: Use credit cards responsibly to avoid accumulating high-interest debt.

- Shop Around: Compare credit card offers, considering interest rates, fees, and rewards.

- Separate Finances: Keep personal and business expenses separate to simplify accounting and tax reporting.

While credit cards can provide a convenient financial cushion, they should be used judiciously, especially considering their higher interest rates. They work best for short-term needs and are not a substitute for more robust, long-term financing solutions.

Conclusion

In the diverse landscape of startup funding, the key lies in finding the right fit for your unique venture. From traditional methods like business loans to cutting-edge options like equity crowdfunding, each avenue offers distinct advantages and challenges. The entrepreneurial journey is about flexibility, adaptation, and choosing the path that aligns best with your startup’s goals. You must choose the paths that are best for you and your startup. And it will likely include a combination of these ways to fund a startup. May your funding strategy propel your venture forward, and may your entrepreneurial spirit lead to success. Happy funding!